Risk Management

risk management

Risk management is designed to plan, monitor and control those measures needed to prevent exposure to risk. To do this it is necessary to identify the hazard, assess the extent of the risk, provide measures to control the risk and manage any residual risks.

Our 5 step process to risk management

When it comes to risk management we strongly believe in a 5 step process to deal with situation before or after they take place.

Our process is to: (1) identify the risks, (2) analyse the risk, (3) prioritise the risks, (4)treat the risk and finally (5) monitor the risk and make adjustments if needed.

1. Identify the risk

Determining possible risks in a project isn’t always a negative thing, in fact it can be used in a positive learning curve for your staff or team and prevent major risks from happening “as prevention is always better then a cure”.

Our team uses a risk breakdown structure to determine potential risks in a project or situation and organises them according to level of details , meaning we place high risk as a major priority and not so high risk at the bottom of the list determining what needs to be resolved urgently.

2. Analysing the risk

Once our team identifies possible problems or risks, it’s time to dig a little deeper. In doing so we can determine how likely these risks will occur and what will the repercussions be if they were to take place.

During this process our team will estimate the possibilities of each risk to decide what the potential risk may be and where to focus first. When putting risk under intensive investigation you will often find common issue across the entire project and this will help with future planning.

3. Evaluate or Rank the Risk

Risks need to be ranked and prioritized. Most risk management solutions have different categories of risks, depending on the severity of the risk. A risk that may cause some inconvenience is rated lowly, risks that can result in catastrophic problems are rated the highest. It is important to rank risks because it allows us to gain a holistic view of the risk exposure of the whole organization or project. The business may be vulnerable to several low-level risks, but it may not require upper management intervention. On the other hand, just one of the highest-rated risks is enough to require immediate intervention.

4. Treat the Risk

Every risk needs to be eliminated or contained as much as possible. Our team of experts will be able to manage the risk but its important to know that this entails contacting each and every stakeholder and then setting up meetings so everyone can talk and discuss the issues. The problem is that the discussion is broken into many different email threads, across different documents and spreadsheets, and many different phone calls. In a risk management solution, all the relevant stakeholders can be sent notifications from within the system. The discussion regarding the risk and its possible solution can take place from within the system. Upper management can also keep a close eye on the solutions being suggested and the progress being made within the system. Instead of everyone contacting each other to get updates, everyone can get updates directly from within the risk management solution.

5 .Monitor and Review the Risk

Not all risks can be eliminated – some risks are always present. These risks are generally caused from 3rd parties or outside sources and needs to be addressed immediately. Once our team of experts have dealt with the situation, we put procedures in place to review and monitor the risk to ensure that everything operates as it should. Our team is specialised in multiple field and put our clients needs first. If any risks arise during the process, we put another solution in motion.

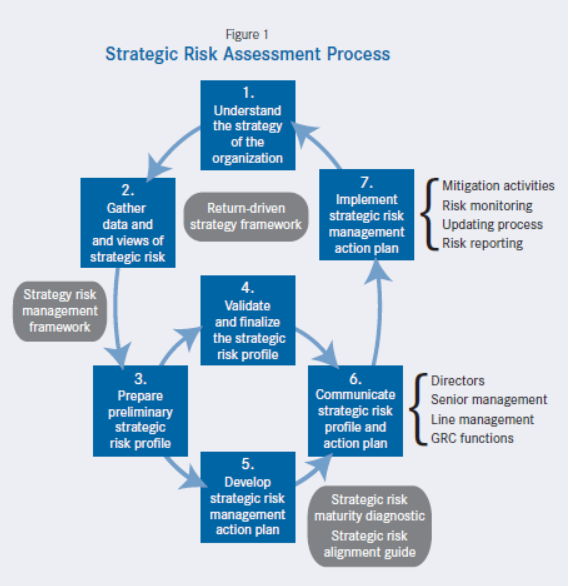

Strategic Risk Management: A Primer for Directors

This article focuses on two key aspects of the relationship between risk and strategy: (1) understanding the organization’s strategic risks and the related risk management processes, and (2) understanding how risk is considered and embedded in the organization’s strategy setting and performance measurement processes. These two areas not only deserve the attention of boards, but also fit closely with one of the primary responsibilities of the board — risk oversight.